Informationen für Studierende

Projekte in die Praxis umsetzen

Wer Projekte in Kooperation, im Projektmanagement in Unternehmen/Organisationen oder als Gründer*in verwirklichen will, braucht nicht nur fachliches Know-how, sondern auch Mut, Motivation und eine unternehmerische Haltung.

Überlegst du, deine Projektarbeit in die Realität umzusetzen? Gerne unterstützen wir dich auf diesem Weg. Nutze das Scouting und die Beratung.

Die HfG ist Teil eines Gründungsnetzwerks, zu dessen weiteren Partnern Startup SÜD, die Start-up Region Ostwürttemberg, die IHK Ostwürttemberg sowie das in:it co-working lab in Schwäbisch Gmünd zählen. Existenzgründungen werden gefördert.

Bei Bedarf vermitteln wir gerne den Kontakt zu unseren Netzwerkpartnern. Sprich uns an! ed.dneumg-gfh@kcolrom.nilorac

Nachhaltigkeit

Finde für deine ökologische oder soziale Idee passende Geschäftsmodelle und Finanzierungsmöglichkeiten!

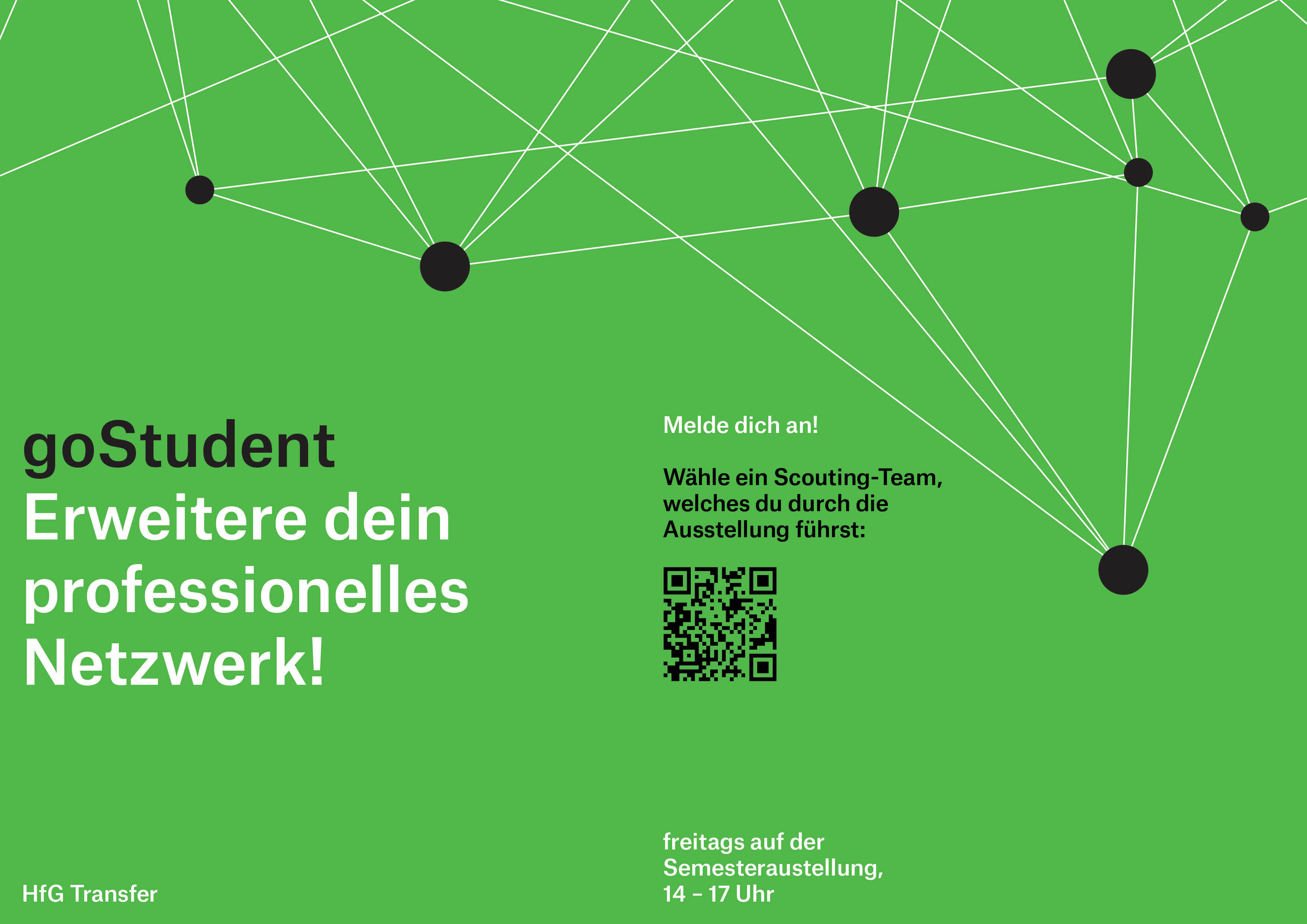

HfG Netzwerk

Finde Scouts und Mentor*innen im HfG-Netzwerk und registiere dich nach deinem Studium.